Overall, AvaTrade is a reputable CFD and Forex broker that provides diverse financial instruments such as currency pairings, commodities, indices, and cryptocurrencies.

The broker, founded in 2006, is licensed by several financial agencies, assuring a safe trading environment.

AvaTrade caters to beginner and expert traders with its user-friendly interfaces, powerful trading tools, and instructional materials.

In this in-depth review, you’ll find the following information:

- A complete AvaTrade broker review

- AvaTrade minimum deposit amount details

- An Overview of AvaTrade Account Types

- Details regarding the AvaTrade Demo account

- Steps to sign up for AvaTrade real account

- Steps to make an AvaTrade withdrawal

- AvaTrade vs Exness vs Pepperstone

- Pros and Cons of AvaTrade

And lots more…

Let’s dive right in…

AvaTrade at a Glance

| 𝗕𝗿𝗼𝗸𝗲𝗿 | 𝗔𝘃𝗮𝗧𝗿𝗮𝗱𝗲 |

|---|---|

| 📜 Regulated | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 🎁 Sign Up Bonus | Yes |

| 🕖 Time to open an account | 1 day |

| 🥇Publicly Traded (Listed Company) | No |

| 🔥Live support | 24/5 |

| 🗺️ Country of regulation | Australia, Ireland, South Africa, Japan, British Virgin Islands, UAE |

| 📊Trading Islamic Account | Yes |

| 💳 Demo Trading Account | Yes |

| 💰Spreads | From 0.9 pips on Standard, 0.6 pips on Pro |

| 💰Leverage | 1:30 (Retail), 1:400 (Pro) |

| 💰 Minimum deposit | $100 USD |

| 📙 Website Languages | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| 💵 Account currencies | ZAR, USD, GBP, or AUD |

| 🥇 Trading Instruments | Forex, Stocks, Commodities, Crypto, Treasuries, Bonds, Indices, Exchange-Traded Funds (ETFs), Options, CFDs, Precious Metals, Energies |

| 📈 Trading Platforms | MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaTrade Web, AvaOptions, AvaSocial, DupliTrade, ZuluTrade |

| 🎓Affiliate Program | Yes |

| 🚀 Open a account | 👉Click Here |

Min Deposit

USD 100

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, ISA

Trading Desk

MT4, MT5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

AvaTrade Review – 21 Key Point Overview

- ☑️AvaTrade at a Glance

- ☑️AvaTrade Overview

- ☑️Is AvaTrade Regulated?

- ☑️AvaTrade Minimum Deposit

- ☑️Types of AvaTrade Accounts

- AvaTrade Sign-Up Bonus

- AvaTrade Demo Account

- AvaTrade Islamic Account

- How to Open an AvaTrade Account – Step-by-Step Guide

- AvaTrade Pros and Cons

- AvaTrade VS Exness VS Pepperstone – Comparison Table

- AvaTrade Customer Reviews

- Deposits and Withdrawal

- Steps to Withdraw Funds from AvaTrade Account

- AvaTrade Fees, Spreads, and Commission

- AvaTrade Social Trading

- AvaTrade Partnership Options

- AvaTrade Product Portfolio

- AvaTrade Broker Trading Platforms

- Conclusion

- Frequently Asked Questions

AvaTrade Overview

| 🔎 𝗕𝗿𝗼𝗸𝗲𝗿 | 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 💰 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗗𝗲𝗽𝗼𝘀𝗶𝘁 | 🌎 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘀 |

|---|---|---|---|

| AvaTrade | 👉Click Here | $100 USD | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

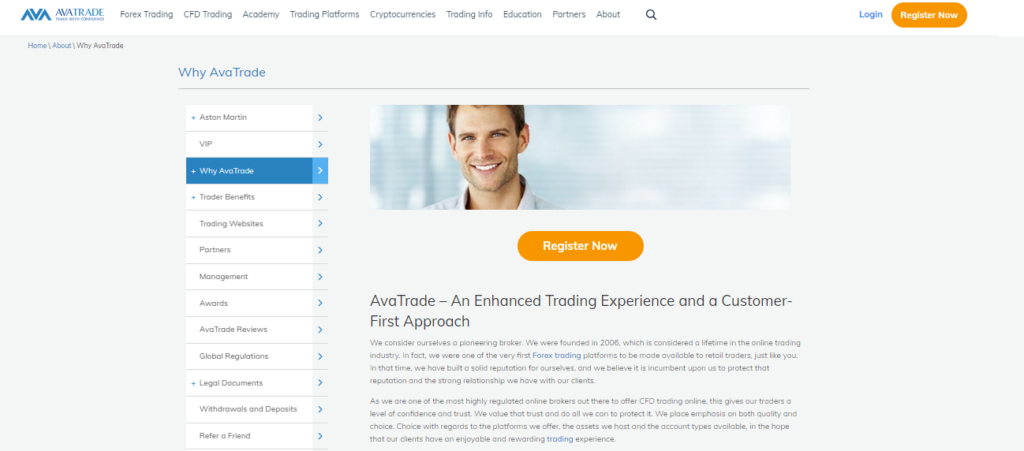

AvaTrade is a well-known CFD and Forex company in business since 2006. It is regulated by numerous financial agencies, including the Central Bank of Ireland, ASIC in Australia, and the FSCA in South Africa, and it provides its clients with a high degree of security and transparency.

The broker offers trading in various financial markets, including Forex, commodities, indices, equities, and cryptocurrencies.

One of AvaTrade’s distinguishing advantages is its selection of trading platforms. It provides the widely-known MetaTrader 4 and MetaTrader 5 platforms and its own AvaTradeGO and AvaOptions platforms.

These systems offer extensive charting tools, indicators, and automated trading to traders of various skill levels.

AvaTrade’s educational materials are another great attribute. The broker provides an extensive learning centre with webinars, eBooks, and video lessons to improve trading abilities and market understanding.

Customer service is available 24 hours a day, five days a week, through various channels, including live chat, phone, and email.

AvaTrade provides a versatile and user-friendly trading environment with competitive spreads, a range of account types, and a minimum deposit requirement that suits both small and large investors. Overall, it is a dependable and adaptable broker that can meet several trading demands.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Is AvaTrade Regulated?

Yes, AvaTrade is regulated by the following regulatory entities:

- Central Bank of Ireland (CBI)

- Australian Securities and Investment Commission (ASIC)

- Japanese Financial Services Authority (JFSA)

- Financial Futures Association of Japan (FFAJ)

- Investment Industry Regulatory Organization of Canada (IIROC) through Friedberg Mercantile

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA)

- Israel Securities Authority (ISA)

- Abu Dhabi Global Market Financial Services Regulatory Authority (ADGM FRSA)

- Polish Financial Supervision Authority (KNF)

- British Virgin Islands Financial Service Commission (BVI FSC)

| 🥇 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘀 | 📌 𝗔𝗯𝗯𝗿𝗲𝘃𝗶𝗮𝘁𝗶𝗼𝗻 | 🔎 𝗟𝗶𝗰𝗲𝗻𝘀𝗲 𝗻𝘂𝗺𝗯𝗲𝗿 |

|---|---|---|

| 🥇Central Bank of Ireland | CBI | C53877 |

| 🥈Polish Financial Supervision Authority | KNF | 693023 |

| 🥉 British Virgin Islands Financial Service Commission | BVI FSC | SIBA/L/13/1049 |

| 🥇 Australian Securities and Investment Commission | ASIC | 406684 |

| 🥈 Japanese Financial Services Authority | JFSA | JFSA 1662 |

| 🥉Financial Futures Association of Japan | FFAJ | FFAJ 1574 |

| 🥈 Abu Dhabi Global Market Financial Services Regulatory Authority | ADGM | 190018 |

| 🥇 Israel Securities Authority | ISA | 514666577 |

| 🥈 Investment Industry Regulatory Organization of Canada | IIROC | Friedberg Mercantile |

| 🥈Cyprus Securities and Exchange Commission | 🖋 CySEC | 247/17 |

| 🥈Financial Sector Conduct Authority | 🖋 FSCA | FSP 45984 |

AvaTrade Minimum Deposit

AvaTrade has a minimum deposit requirement of $100 to register a retail live trading account. The minimum deposit in ZAR equals the trading value between the US Dollar and the South African Rand.

| 💻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 💰 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗗𝗲𝗽𝗼𝘀𝗶𝘁 |

|---|---|---|

| 📌 Standard Account | 👉Click Here | $100 USD |

| 📌 Professional Account | 👉Click Here | $100 USD |

Types of AvaTrade Accounts

Standard Account

| 💻 𝗔𝘀𝗽𝗲𝗰𝘁𝘀 | 🥇 𝗦𝘁𝗮𝗻𝗱𝗮𝗿𝗱 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 |

|---|---|

| Maximum leverage | 400:1 |

| Minimum deposit | $100 USD |

| Spread | From 0.9 |

| Commission | No commission |

| Instruments | Forex, Cryptocurrencies, Stocks, Indices, FX Options, Bonds, ETFs |

| Swap-free | Available |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

The AvaTrade retail account is intended for individual traders who want a simple and safe trading experience. The account provides access to a wide range of financial markets, including Forex and CFDs.

It is accessible to traders with varied investment capabilities due to a fair minimum deposit requirement. The retail account is available on various trading platforms, giving you flexibility and convenience.

Overall, the AvaTrade retail account is a dependable alternative for anyone looking for a well-balanced mix of features without being overly complicated. Below are the features that traders can expect from the AvaTrade retail account:

- The minimum account deposit is 100 units, which can be made in ZAR, USD, GBP, or AUD.

- The base account currencies are ZAR, USD, GBP, or AUD.

- The maximum leverage varies based on account type, ranging from 1:30 for retail accounts to 1:400 for professional accounts.

- The broker offers access to over 1,260 tradable instruments across various markets.

- Multiple trading platforms are supported, such as AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, and ZuluTrade.

- There are no commissions on transactions, resulting in a transparent cost structure.

- Average spreads for EUR/USD currency pairs begin at 0.9 pips.

- With a leverage of 1:400, the minimum margin requirement is 0.25%.

- Customer service is comprehensive and accessible via social media, email, telephone, WhatsApp, and live conversation.

- All trading strategies are permitted, allowing for a variety of trading approaches.

Professional Account

| 💻 𝗔𝘀𝗽𝗲𝗰𝘁𝘀 | 🥇 𝗣𝗿𝗼𝗳𝗲𝘀𝘀𝗶𝗼𝗻𝗮𝗹 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 |

|---|---|

| To Qualify | 12 Months Experience |

| Requirements | Financial instrument portfolio of over €500,000 (including cash saving and financial instruments) |

| Maximum leverage | 400:1 |

| Minimum deposit | $100 USD |

| Spread | From 0.9 |

| Commission | No commission |

| Instruments | Forex, Cryptocurrencies, Stocks, Indices, FX Options, Bonds, ETFs |

| Swap-free | Available |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

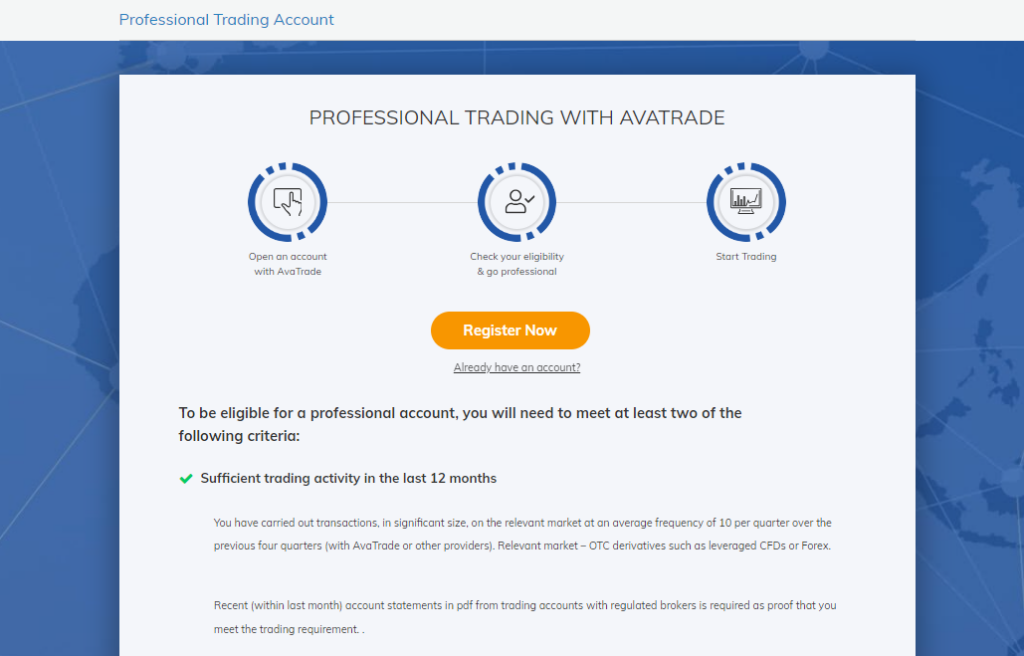

The AvaTrade Professional Account is designed specifically for accredited investors and offers several advantages over the Standard account. One of the main advantages is a more competitive EUR/USD spread, averaging 0.6 pips versus 0.9 pips for the Standard account.

In addition, there are no transaction fees, which is financially advantageous for active merchants. Professional Account users also have the option to connect their accounts with third-party trading platforms, such as DupliTrade or ZuluTrade, to improve their trading capabilities.

To qualify for this specialized account, traders must satisfy the following requirements:

- Minimum of one year of consistent trading experience in relevant financial markets. The average number of CFD, FX, and spread wagering transactions during the past four quarters should have been at least ten.

- Applicants must have at least one year of work experience in the financial services industry.

- A minimum investment portfolio of €500,000 (or the equivalent in other currencies) is required, consisting of cash and financial instruments.

Min Deposit

USD 100

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, ISA

Trading Desk

MT4, MT5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

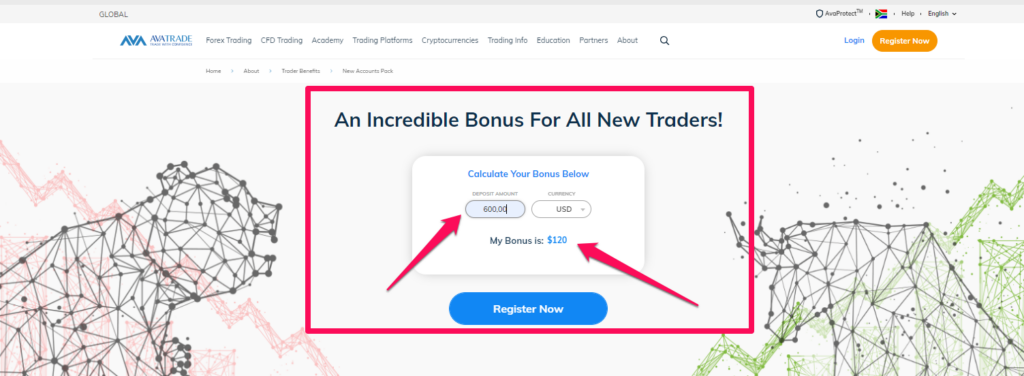

AvaTrade Sign-Up Bonus

AvaTrade does not provide a Sign-Up bonus to traders who register a new trading account. However, AvaTrade has a lucrative partner and affiliate program.

| 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 | 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 |

|---|---|

| 🥈Broker | AvaTrade |

| 💰 Sign Up Bonus | Yes |

| 📝Partnership Option | Yes |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

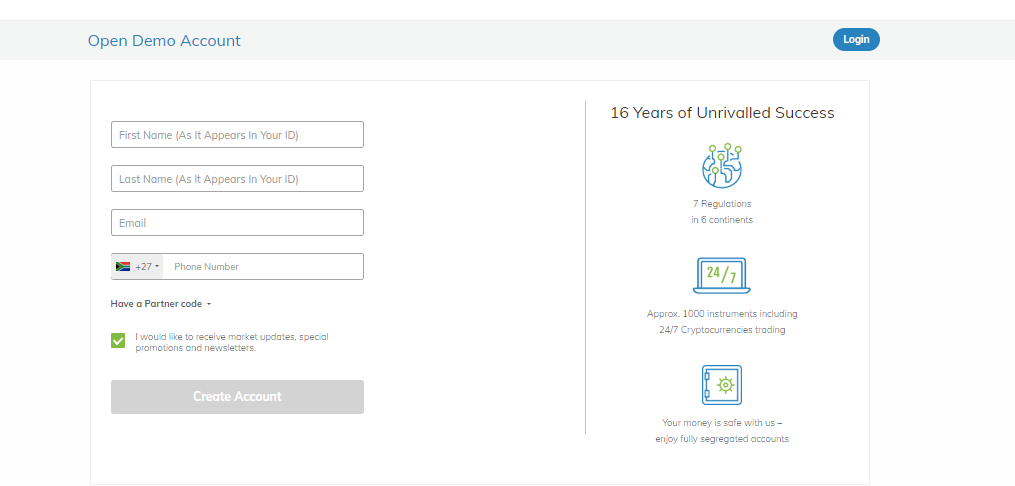

AvaTrade Demo Account

The AvaTrade trial account is an excellent way for traders to become acquainted with the broker’s trading platform and market pricing without incurring any financial risk. The demo account enables users to safely try the waters on the forex market, making it ideal for beginners.

Registration is straightforward and can be accomplished by completing a brief form with personal information or logging in with social media accounts such as Facebook or Google.

In contrast to active accounts, the demo account requires no identification or verification documents, making it easy to get started.

The account includes virtual funds of up to $100,000 for educational purposes only. Despite being a risk-free environment, the demo account provides traders access to all AvaTrade markets. This allows them to refine their trading strategies and test new approaches without incurring any financial risk.

| 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 | 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 |

|---|---|

| 🥈Broker | AvaTrade |

| 💰 Demo Account | Yes |

| 📝Virtually Funded | $10 000 USD |

| 💻Terminal Access | Full |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

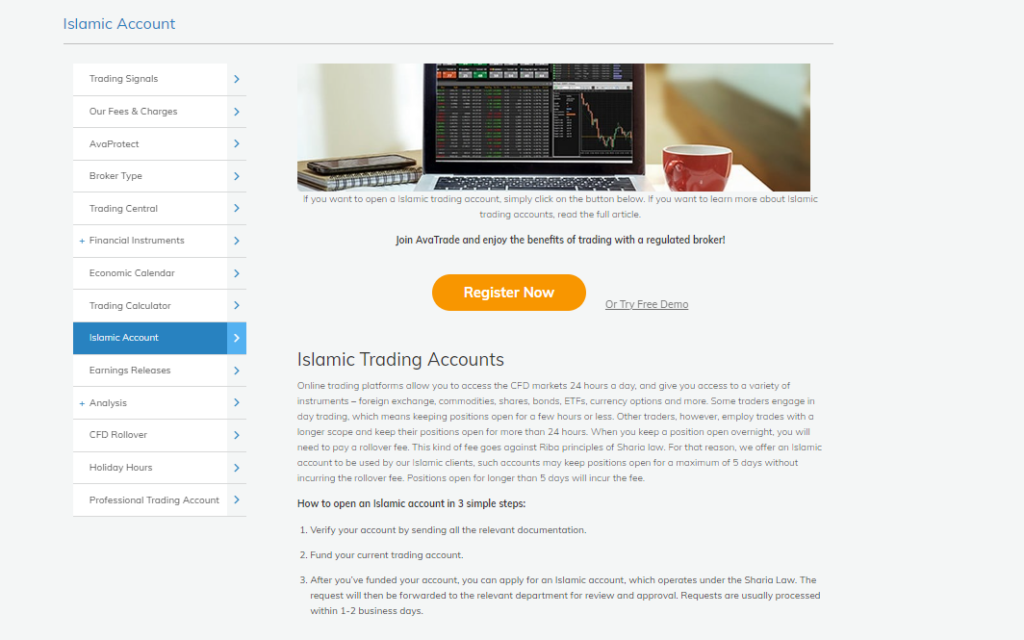

AvaTrade Islamic Account

The AvaTrade Islamic account is designed to fulfil Muslim merchants’ demands while conforming to Islamic financial rules.

This account has the same trading conditions as the ordinary account, but no interest or fees are charged, making it Sharia-compliant.

Traders who have an AvaTrade Islamic account can engage in a variety of financial transactions that are permitted under Islamic law. Halal trading in gold and silver, oil, indices, and Forex are among them.

Overall, the Islamic account offers Muslim investors a complete and ethical investing environment.

| 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 | 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 |

|---|---|

| 🥈Broker | AvaTrade |

| 💰 Islamic Account | Yes |

| 📝Accounts Offered | Standard / Professional |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

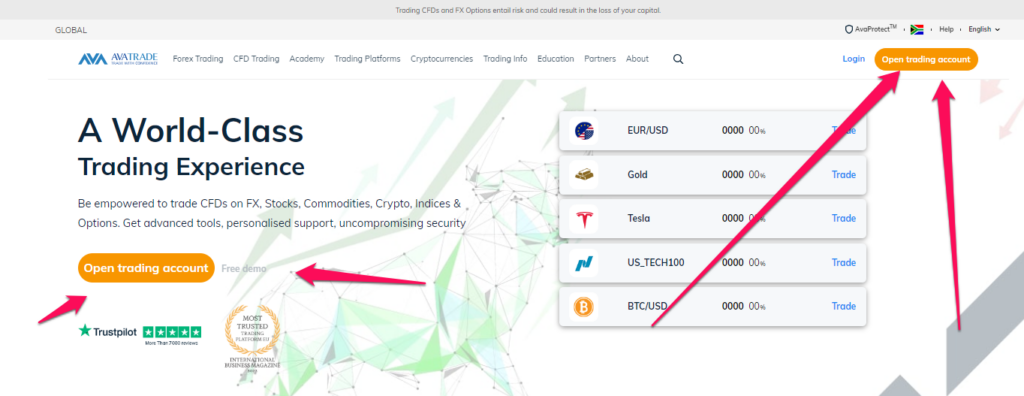

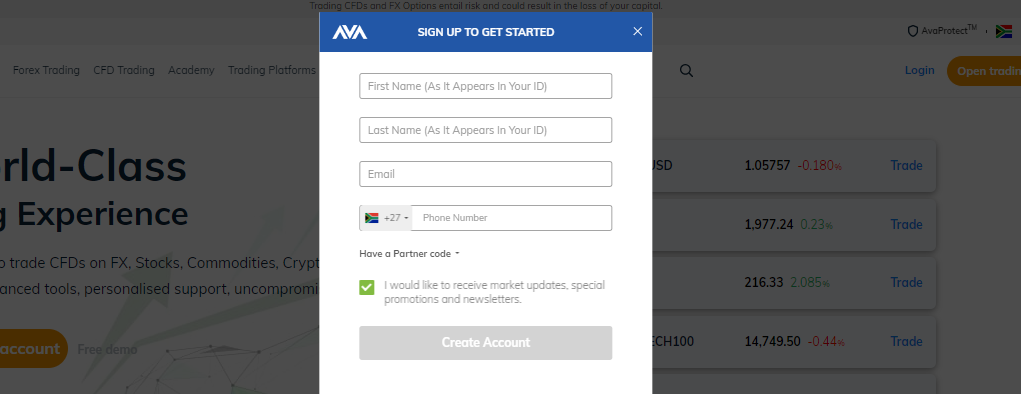

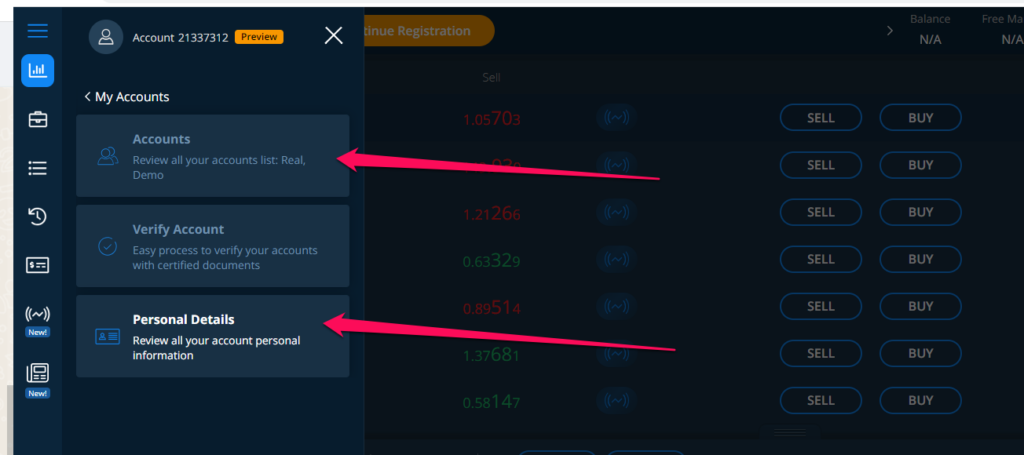

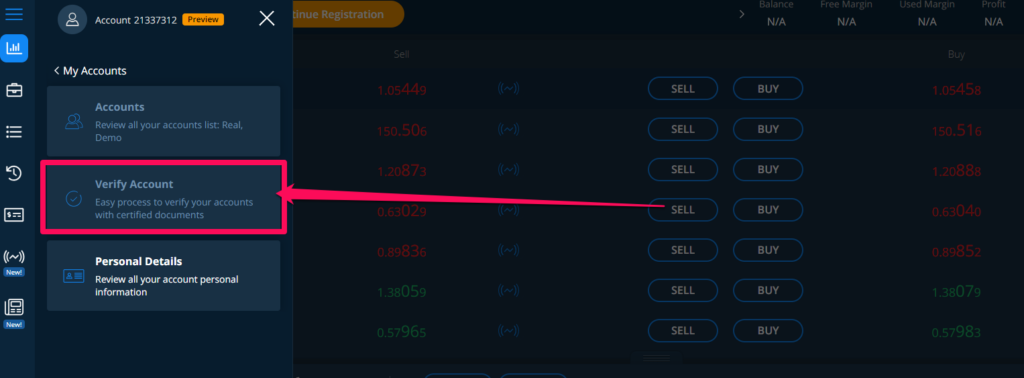

How to Open an AvaTrade Account – Step-by-Step Guide

Opening an account with AvaTrade and starting FX and CFD trading simply takes a few minutes. Here is how you can register an AvaTrade account:

1. Step 1: Start your Registration

To begin the account opening procedure, go to the official AvaTrade website.

2. Step 2: Fill Out the Registration Form

You will be asked to complete a registration form. Personal information such as your name, email address, and phone number are necessary. Once the account is opened you would need to complete the personal details section accompanied by your ID documentation.

3. Step 3: Choose Account Type

Select the account type you want to open, such as Standard, Professional, Islamic, or Demo.

4. Step 4: Account verification

Once you receive a verification email on the registered email account and once verified you can go to login and start trading.

5. Step 5: Start trading

Once all the information is competed and your account is setup. You can login and start making your first deposit to trade.

AvaTrade Pros and Cons

| ✅ 𝗣𝗿𝗼𝘀 | ✅ 𝗖𝗼𝗻𝘀 |

|---|---|

| AvaTrade provides a diverse range of trading products, including Forex, CFDs, cryptocurrencies, and options | The desktop platform of AvaOptions is sluggish to load and has an old look that does not match the clean, responsive style of its mobile equivalent |

| AvaTrade has several deposit and withdrawal options, all of which are free | With AvaTrade, at least 351 of the 1,260 accessible symbols are on hold for both the MetaTrader and WebTrader platforms |

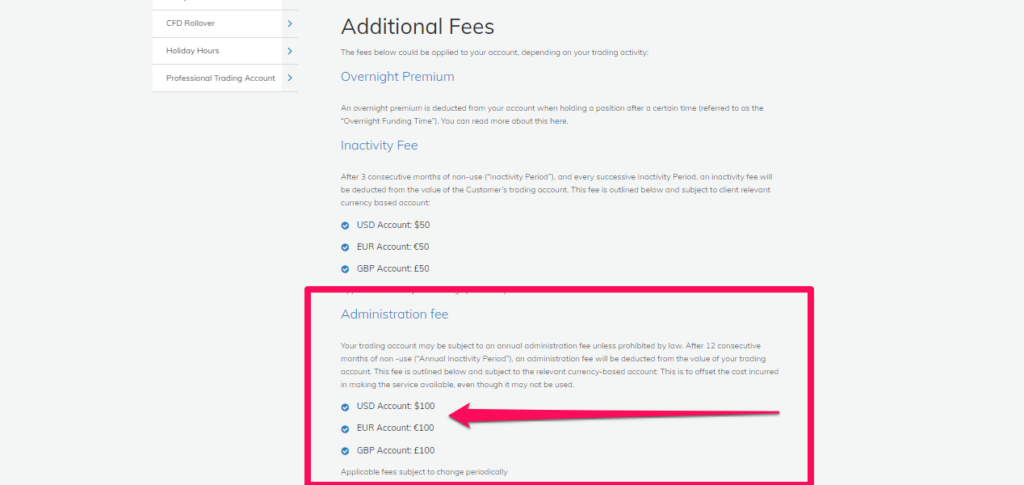

| AvaTrade provides a diverse range of trading products, including Forex, CFDs, cryptocurrencies, and options | The penalties for inactivity are costly |

| Account opening is simple and entirely digital | For many traders, the demo account limit of 21 days may be too short |

| AvaTrade protects against negative balances | The product offering is confined to Forex, CFDs, and cryptocurrency |

| AvaTrade has received several accolades, including “Best Customer Support,” “Best Alert System,” “Best Financial Derivative Trading Provider,” and “Best Forex Broker of the Year” | |

| AvaTrade provides outstanding instructional and research resources, including demo accounts, etc. | |

| AvaTrade provides flexible accounts, including an Islamic account | |

| AvaTrade is a registered broker that is regarded as secure and trustworthy | |

| AvaTrade provides a variety of trading platforms, including a specialized options trading platform, as well as its own mobile app and social trading platform |

AvaTrade VS Exness VS Pepperstone – Comparison Table

| 𝗔𝘀𝗽𝗲𝗰𝘁𝘀 | 𝗔𝘃𝗮𝗧𝗿𝗮𝗱𝗲 | 𝗘𝘅𝗻𝗲𝘀𝘀 | 𝗣𝗲𝗽𝗽𝗲𝗿𝘀𝘁𝗼𝗻𝗲 |

|---|---|---|---|

| Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| Minimum Deposit | $100 USD | $10 USD | AU$200 |

| Account Types | Standard, Professional, Islamic | Standard, Standard Cent, Raw Spread, Zero, Pro, Social Standard, Social Pro | Standard, Razor |

| Leverage | 1:30 (Retail), 1:400 (Pro) | 1:Unlimited | 1:200 (Retail), 1:500 (Pro) |

| Trading Instruments | Forex, Stocks, Commodities, Crypto, Treasuries, Bonds, Indices, Exchange-Traded Funds (ETFs), Options, CFDs, Precious Metals, Energies | Forex, Metals, Crypto, Energies, Indices, Stocks | Forex, Crypto, Shares, ETFs, Indices, Commodities, Currency Indices |

| Spreads | Fixed, Competitive | Flexible, Competitive | Flexible, Competitive |

| Trading Platforms | MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaTrade Web, AvaOptions, AvaSocial, DupliTrade, ZuluTrade | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness App | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

| 🚀𝑶𝒑𝒆𝒏 𝒂𝒏 𝑨𝒄𝒄𝒐𝒖𝒏𝒕 | 👉Click Here | 👉Click Here | 👉Click Here |

AvaTrade Customer Reviews

Broker of choice

After becoming familiar with AvaTrade, I have no desire to investigate other brokerages. AvaTrade stands out from the crowd thanks to its reasonable spreads, unique trading tools, fast deposit and withdrawal procedures, and, most importantly, its superb customer support

![]()

Great assistance

When it came to getting my account set up, AvaTrade was a huge help. The company also provided me with training materials to help me learn how to use their trading platform.

![]()

Customer service

I want to thank my AvaTrade account manager for the excellent service I’ve received. The account manager quickly validated my account and made me feel like a valuable addition to the team. As a novice trader, I value AvaTrade’s assistance and education resources. I know I can get answers to my questions about trading by contacting AvaTrade’s Help Centre.

![]()

Deposits and Withdrawal

AvaTrade provides several deposit and withdrawal options, making it simple for traders to fund their accounts and withdraw earnings.

- AvaTrade accepts various payment methods for your trading account, including credit cards, debit cards, and wire transfers.

- A $100 deposit is required to start an account with AvaTrade.

- Credit cards (VISA, MasterCard, and Debit), bank wire transfers, and a variety of E-Wallets such as PayPal, Skrill, NETELLER, and WebMoney may all be used to make deposits.

- Deposit fees are irrelevant with AvaTrade because the broker does not charge deposit fees.

| 🥉𝗪𝗶𝘁𝗵𝗱𝗿𝗮𝘄𝗮𝗹 𝗦𝗲𝗹𝗲𝗰𝘁𝗶𝗼𝗻 | 🥇𝗧𝗶𝗺𝗲 𝗙𝗿𝗮𝗺𝗲 |

|---|---|

| Bank Wire Transfer | Up to 10 days |

| Credit/Debit Card | 24 – 48 hours |

| PayPal | 24 – 48 hours |

| WebMoney | 24 – 48 hours |

| Neteller | 24 – 48 hours |

| Skrill | 24 – 48 hours |

Steps to Withdraw Funds from AvaTrade Account

| 𝗦𝘁𝗲𝗽𝘀 | 𝗪𝗶𝘁𝗵𝗱𝗿𝗮𝘄𝗮𝗹 𝗳𝗿𝗼𝗺 𝗔𝘃𝗮𝗧𝗿𝗮𝗱𝗲 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 |

|---|---|

| 𝗦𝘁𝗲𝗽 𝟭: | Enter your email address and password to access your AvaTrade account. |

| 𝗦𝘁𝗲𝗽 𝟮: | On the left-hand menu, select the “Withdraw Funds” option. |

| 𝗦𝘁𝗲𝗽 𝟯: | Choose your desired withdrawal method from the available options. |

| 𝗦𝘁𝗲𝗽 𝟰: | Enter the amount to be withdrawn. |

| 𝗦𝘁𝗲𝗽 𝟱: | If you have more than one credit/debit card on file, AvaTrade will transfer the funds to the one you specify, but traders must withdraw the initial deposit amount to the same card. |

| 𝗦𝘁𝗲𝗽 𝟲: | To send the withdrawal request to AvaTrade, click “Submit.” |

| 𝗦𝘁𝗲𝗽 𝟳: | Enter your email address and password to access your AvaTrade account. |

Rules to follow when withdrawing funds from AvaTrade:

- If a trader deposits a third party, they must withdraw the whole amount using the original payment method.

- AvaTrade withdrawals are only available to verified accounts, and the payment processor must match the name on the AvaTrade trading account.

- Traders can only withdraw cash to their own accounts.

- If a trader deposits $1,000 by credit card and makes a $1,200 profit, the first $1,000 they withdraw must be returned to the same credit card before they may withdraw the winnings via another means, such as wire transfer or other e-payment methods (for non-EU customers only).

- Withdrawals must follow the deposit channel and cover the deposit amount per anti-money laundering (AML) requirements. Withdrawals may only be made using the payment methods used to fund your account.

- Traders must withdraw up to 100% of their deposit to their credit or debit card before using another method in their own name as directed.

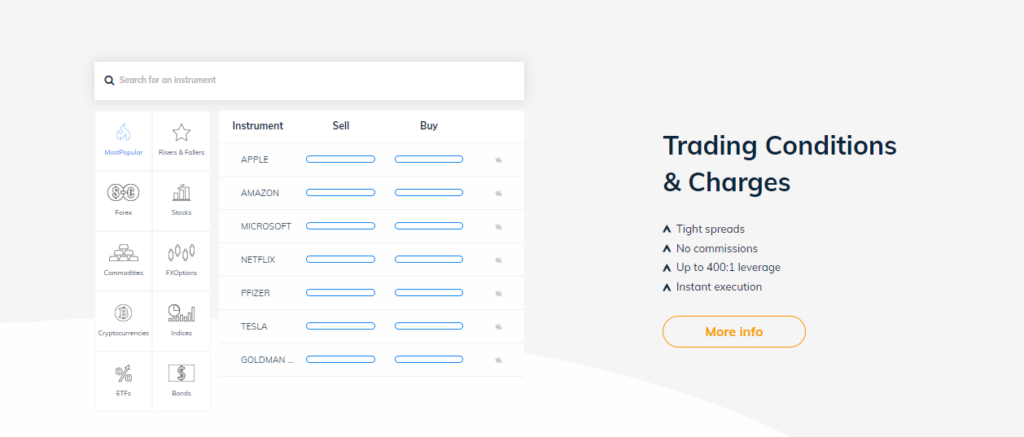

AvaTrade Fees, Spreads, and Commission

Forex traders only pay trading costs when they open and cancel positions.

These charges will compensate AvaTrade when you use its brokerage services and solutions.

| 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 𝘁𝘆𝗽𝗲𝘀 | 𝗦𝗽𝗿𝗲𝗮𝗱𝘀 | 𝗖𝗼𝗺𝗺𝗶𝘀𝘀𝗶𝗼𝗻𝘀 | 𝗦𝘄𝗮𝗽 𝗿𝗮𝘁𝗲𝘀 | 𝗠𝗮𝗿𝗴𝗶𝗻 𝗥𝗲𝗾𝘂𝗶𝗿𝗲𝗺𝗲𝗻𝘁 |

|---|---|---|---|---|

| 📌 Standard | 0.9 pips | $0 | Long Swap of -0.000%, Long Swap of -0.0083% | 0.25% |

| 📌 Islamic | 0.9 pips | $0 | Long Swap of -0.000%, Long Swap of -0.0083% | 0.25% |

| 📌 Professional | 0.6 pips | $0 | Long Swap of -0.000%, Long Swap of -0.0083% | 0.25% |

AvaTrade Social Trading

➡️ AvaTrade provides a variety of social trading platforms, including its proprietary mobile social trading platform, AvaSocial, which allows users to copy trades of professionals through an easy-to-use interface.

➡️ AvaSocial is intended to assist traders in making better trading decisions by giving them access to a community of traders who share their knowledge and expertise. The app is available on both iOS and Android devices, allowing traders on the go to use it.

➡️ AvaSocial also has features that make it simple for traders to find and follow other traders, such as a search function that allows traders to find other traders based on trading style, performance, and other criteria.

➡️ AvaTrade offers the services of three leading providers and its proprietary social trading platform: ZuluTrade, MQL5, and DupliTrade. AvaTrade’s copy trading platforms have thousands of signal providers and advanced statistics and search filters.

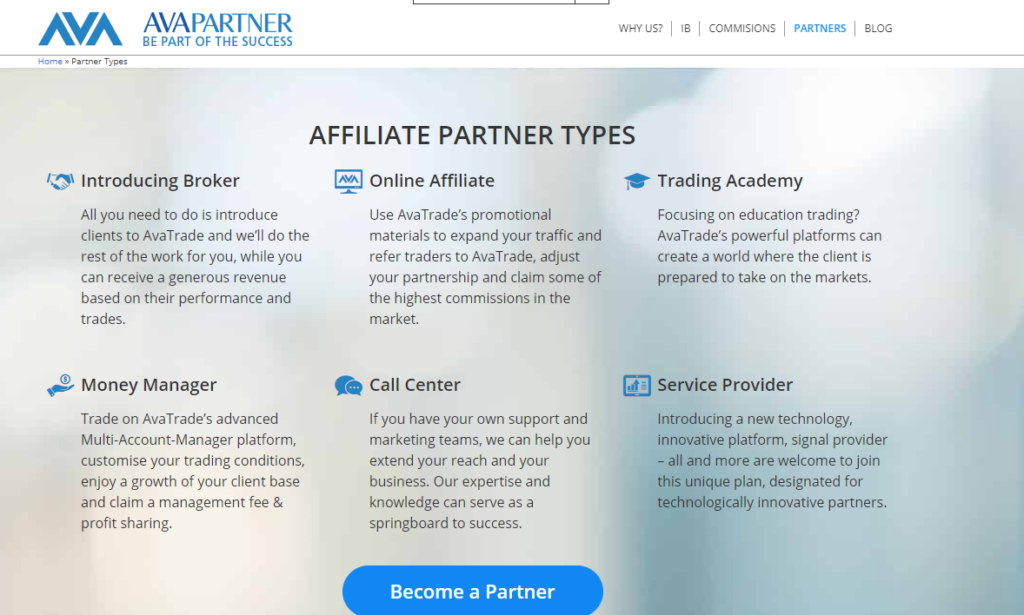

AvaTrade Partnership Options

AvaTrade provides a selection of partnership options, such as:

➡️️ Introducing Broker,

➡️️ Flexible White Label,

➡️️ Tied Agent,

➡️️ Business Partner,

➡️️ Online Affiliate Manager,

➡️️ Trading Academy

AvaTrade provides various partnership opportunities to accommodate various business models and individual requirements.

One of the most popular options is the Introducing Broker (IB) program, which enables individuals or organizations to refer new clients to AvaTrade and earn a commission based on the trading activity of those clients.

This program is especially advantageous for financial advisors, bloggers, and anyone with a trading-focused network.

The White Label partnership is ideal for financial institutions seeking to expand their service offerings while avoiding the complexities of developing a trading platform from scratch

Targeting online marketers and influencers with affiliate partnerships is another option. Affiliates can generate revenue by promoting AvaTrade via multiple online channels, such as blogs, social media, and email marketing.

AvaTrade provides affiliates various marketing materials and tracking tools to optimize their campaigns for maximum reach and conversion.

In addition, AvaTrade provides the Money Manager and Sub-IB programs, which are designed for professional portfolio managers and individuals or companies that can introduce sub-affiliates, respectively.

These applications include sophisticated tools for performance analysis, client management, and reporting.

AvaTrade Product Portfolio

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗔𝘃𝗮𝗧𝗿𝗮𝗱𝗲 |

|---|---|

| Forex Trading | Yes |

| CFDs | More than 1,260 |

| Forex Pairs | 55 |

| Cryptocurrency (Physical) | 0 |

| Cryptocurrency (CFD) | 20 |

| Social Trading | Yes |

AvaTrade Broker Trading Platforms

MetaTrader

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗠𝗲𝘁𝗮𝗧𝗿𝗮𝗱𝗲𝗿 𝟰 | ☑️ 𝗠𝗲𝘁𝗮𝗧𝗿𝗮𝗱𝗲𝗿 𝟱 |

|---|---|---|

| Release Year | 2005 | 2010 |

| Asset Classes | Forex, CFDs | Forex, CFDs, Stocks, |

| Hedging | Supported | Supported |

| Technical Indicators | 30+ | 38+ |

| Compatibility | More widely adopted | Gaining popularity |

| Time & Sales | Not available | Available |

AvaTradeGO

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗔𝘃𝗮𝗧𝗿𝗮𝗱𝗲𝗚𝗢 |

|---|---|

| Available on | iOS, Android |

| Account types | Standard, Professional, Islamic |

| Chart types | Line, Bar, Candlestick |

| Pending orders | Buy Limit, Buy Stop, Sell Limit, Sell Stop |

| Indicators | Moving Averages, Bollinger Bands, MACD, RSI, Stochastic Oscillator, etc. |

| Minimum system requirements | iOS 11.0 or later for Apple devices, Android 5.0 and up for Android devices |

AvaSocial

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗔𝘃𝗮𝗦𝗼𝗰𝗶𝗮𝗹 |

|---|---|

| Available on | iOS, Android, Web Platform |

| Account types | Standard, Professional, Islamic |

| Chart types | Line, Bar, Candlestick, Area |

| Pending orders | Buy Limit, Buy Stop, Sell Limit, Sell Stop, One Cancels the Other (OCO) |

| Indicators | Moving Averages, Bollinger Bands, MACD, RSI, Fibonacci Retracements, etc. |

| Minimum System Requirements | iOS 11.0 or later for Apple devices, Android 5.0 and up for Android devices, Web Browser for Web Platform |

AvaOptions

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗔𝘃𝗮𝗢𝗽𝘁𝗶𝗼𝗻𝘀 |

|---|---|

| Available on | iOS, Android, Web Platform |

| Account types | Standard, Professional, Islamic |

| Chart types | Line, Bar, Candlestick, Area |

| Pending orders | Buy Limit, Buy Stop, Sell Limit, Sell Stop, One Cancels the Other (OCO) |

| Indicators | Moving Averages, Bollinger Bands, MACD, RSI, Fibonacci Retracements, etc. |

| Minimum System Requirements | iOS 11.0 or later for Apple devices, Android 5.0 and up for Android devices, Web Browser for Web Platform |

AvaTrade Web Terminal

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗔𝘃𝗮𝗧𝗿𝗮𝗱𝗲 𝗪𝗲𝗯 𝗧𝗲𝗿𝗺𝗶𝗻𝗮𝗹 |

|---|---|

| Available on | Windows, Mac, Web Platform |

| Account types | Standard, Professional, Islamic |

| Chart types | Line, Bar, Candlestick, Heikin Ashi |

| Pending orders | Buy Limit, Buy Stop, Sell Limit, Sell Stop, One Cancels the Other (OCO) |

| Indicators | Moving Averages, Bollinger Bands, MACD, RSI, Fibonacci Retracements, Ichimoku Cloud, etc. |

| Minimum System Requirements | Windows 7 or later for Windows, macOS X 10.11 or later for Mac, Web Browser for Web Platform |

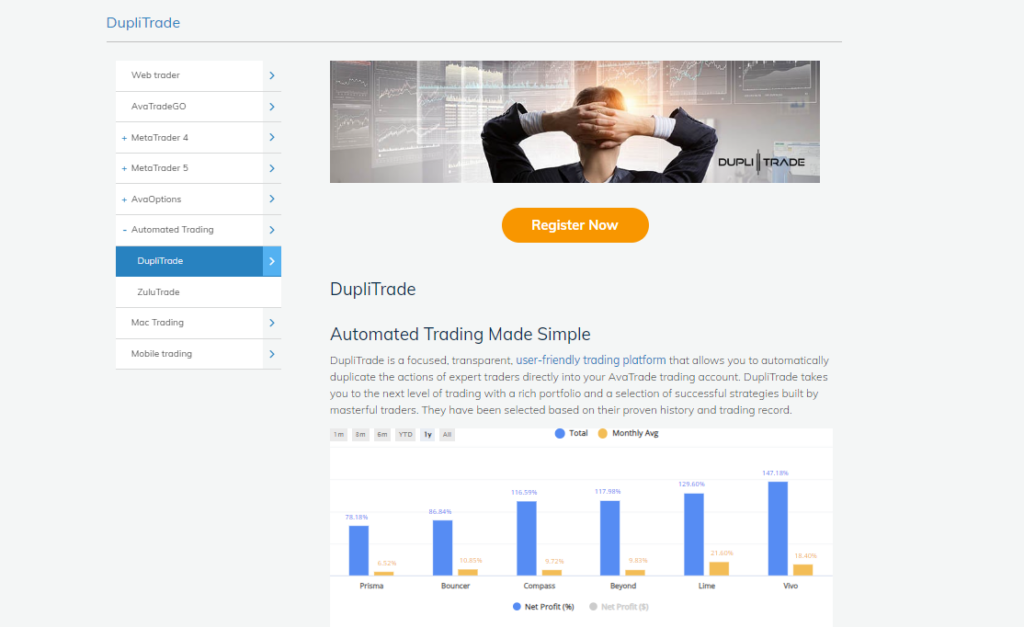

DupliTrade

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗗𝘂𝗽𝗹𝗶𝗧𝗿𝗮𝗱𝗲 |

|---|---|

| Available on | Web Platform |

| Account types | Standard, Professional |

| Chart types | Not Applicable (DupliTrade is a copy-trading platform and does not offer charting capabilities) |

| Pending orders | Buy Limit, Buy Stop, Sell Limit, Sell Stop |

| Indicators | Not Applicable (DupliTrade focuses on replicating trading strategies) |

| Minimum System Requirements | Web Browser |

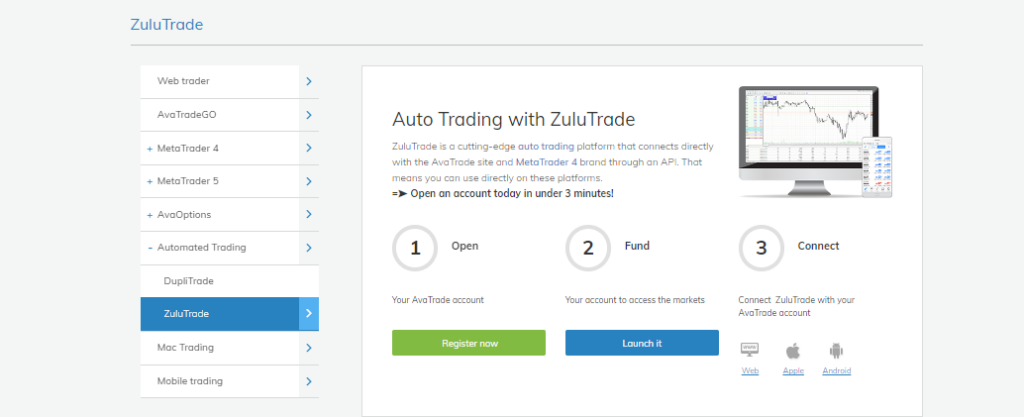

ZuluTrade

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗭𝘂𝗹𝘂𝗧𝗿𝗮𝗱𝗲 |

|---|---|

| Available on | iOS, Android, Web Platform |

| Account types | Standard, Professional |

| Chart types | Line, Bar, Candlestick |

| Pending orders | Buy Limit, Buy Stop, Sell Limit, Sell Stop |

| Indicators | Moving Averages, Bollinger Bands, MACD, RSI, Stochastic Oscillator, etc. |

| Minimum System Requirements | iOS 11.0 or later for Apple devices, Android 5.0 and up for Android devices, Web Browser for Web Platform |

Min Deposit

USD 100

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, ISA

Trading Desk

MT4, MT5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Conclusion

In conclusion, AvaTrade is a comprehensive trading platform suitable for novice and experienced traders. It provides flexibility and ease of use with various trading platforms such as AvaTradeGO, AvaOptions, AvaSocial, and MetaTrader 4 and 5. Also offers a variety of account types to cater to a diverse audience with varying trading needs and ethical concerns. The broker’s zero-commission structure and competitive spreads are among its strong points, making it cost-effective for traders.

Disclaimer

This AvaTrade review is provided solely for informational and educational purposes and should not be construed as financial or investment advice. Before opening an account with any broker, it is crucial to understand the inherent risks of trading on the financial markets.

AvaTrade is a regulated organization, but past performance does not necessarily indicate future results. Before making any trading or investment decisions, you must always perform your own research and consult a qualified financial advisor.

We are not responsible for any losses sustained while trading on AvaTrade or any other financial platform.

You might also like: HF Markets Review

You might also like: Exness Review

You might also like: RoboForex Review

You might also like: Tickmill Review

You might also like: TD Ameritrade Review

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Frequently Asked Questions

Where are the headquarters of AvaTrade?

AvaTrade’s headquarters are located in Dublin, Ireland.

Is AvaTrade Regulated in the United States?

No, AvaTrade is not subject to any regulation in the United States.

What is the minimum deposit in AvaTrade?

AvaTrade requires a minimum deposit of 100 units in ZAR, USD, GBP, or AUD.

Does AvaTrade have a mobile app for Forex trading?

Yes, AvaTrade offers a mobile app for Forex trading called AvaTradeGO. Furthermore, AvaTrade also offers MT4 and MT5 on mobile.

Does AvaTrade have a deposit bonus?

No, AvaTrade does not have a deposit bonus.

Does AvaTrade have Nasdaq?

Yes, AvaTrade offers Nasdaq trading.

Is AvaTrade Regulated in Europe?

Yes, AvaTrade is regulated in Europe by the Central Bank of Ireland.

Does AvaTrade offer demo accounts for Forex trading?

Yes, AvaTrade offers demo Forex trading accounts.

Does AvaTrade have a welcome bonus?

No, AvaTrade does not provide a sign-up bonus.

Is AvaTrade regulated in a Tier-1 Jurisdiction?

Yes, AvaTrade is regulated in Tier-1 countries such as Ireland, Canada, Australia, and Japan.

What are the social media accounts of AvaTrade?

AvaTrade is active on Facebook, Twitter, and Instagram, among others.

Does AvaTrade have online support?

Yes, AvaTrade offers live chat support 24/5.

Is there a commission-free trade bonus in AvaTrade?

No, AvaTrade does not offer a commission-free trade bonus. However, trades are commission-free with AvaTrade.

How does leverage work with AvaTrade?

AvaTrade offers leverage of 1:30 to retail traders and 1:400 to professionals. The leverage you can use will depend on the financial instrument being traded and other factors.

Who is AvaTrade’s CEO?

Dáire Ferguson is the CEO of AvaTrade.

Is there a VIP bonus in AvaTrade?

No, there is no VIP bonus in AvaTrade.

Is AvaTrade regulated in Tier-2 Jurisdiction?

Yes, AvaTrade is regulated by several Tier-2 entities in South Africa, Cyprus, Israel, Abu Dhabi, and Poland.

Does AvaTrade Have a Traders Dashboard?

Yes, AvaTrade’s website provides Traders Dashboard access.

Does AvaTrade publish an economic calendar?

Yes, AvaTrade’s website contains an economic calendar.

Can you start trading with no money at AvaTrade?

No, traders cannot begin trading at AvaTrade with no funds.

How many employees work for AvaTrade?

AvaTrade has more than 300 employees globally.

Table of Contents